The West Coast is looking mighty green these days. As of Jan. 1, 2018, when California joins the growing list of states with legalized recreational cannabis markets, adults 21 years and older will be able to legally purchase, possess and consume marijuana from the Arctic Circle all the way down to the California-Mexico border.

Altogether, eight states and Washington, D.C., have voted to legalize recreational marijuana since 2012. Six of those states — Alaska, California, Colorado, Oregon, Nevada and Washington — are in the West.

Related: Demystifying Cannabis Concentrates

But since legalization has happened at the state level, understanding what is and isn’t allowed in each state can be difficult to figure out.

For example, at Ivy Cannabis on Portland’s Hayden Island in the Columbia River, a customer can purchase up to 5 grams of marijuana concentrates. But a mere 2.4 miles to the north, just off of Interstate 5 in Vancouver, Washington’s Arnada neighborhood, that same adult is allowed to purchase up to 7 grams of concentrate at High End Market Place.

That’s just one example of how each state’s recreational laws differ from one another. To help clear up the confusion, we’ve answered some basic questions about the differences between California’s, Oregon’s and Washington’s recreational markets below.

Who Can Legally Buy Cannabis In California, Oregon And Washington?

This is one area where these three legalized states are in agreement: Adults 21 years of age and older can purchase, possess and consume cannabis. This includes non-residents. Transporting cannabis across state lines, however, remains illegal. Having a valid state or federal ID on hand is a must as each state requires strict adherence to the age requirement.

Legalized sales aren’t set to begin in California until Jan. 1, 2018, when the state starts issuing licenses to stores, processors and distributors. This means it could be tricky for many Golden State residents to find a spot to buy legal marijuana on New Year’s Day.

What Can I Buy And How Much Of It?

What people can purchase and how much of it tends to vary from state to state.

Washington and Oregon, for example, share the same limits on how much marijuana flower (1 ounce) an adult can purchase in a single day, as well as limits on how much infused cannabis edibles (16 ounces) and infused beverages (72 ounces) can be purchased per day. How much marijuana concentrates and extracts a person can buy differs between the two states: Oregon allows up to 5 grams per day and Washington allows up to 7 grams per day.

California also allows for the purchase of up to 1 ounce of marijuana flower, but it has different rules when it comes to concentrates and edibles. The limit for cannabis extract jumps up to 8 grams at a time in the Golden State.

Each state also has various standards for potency of edibles. In Oregon, a package of edibles can contain up to 50 milligrams of THC — the main psychoactive chemical in marijuana that gets users high — not to exceed 5 milligrams per serving. Those limits double in California and Washington to 100 milligrams and 10 milligrams, respectively.

MacGregor Campbell / OPB

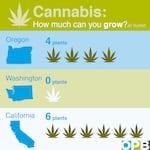

Can I Grow Cannabis At Home?

This is one area where the differences between the states’ laws are the most prominent. For example, California allows each person or residence to grow up to six cannabis plants, while Oregon allows up to four per person or residence.

Then, there’s Washington, where growing recreational marijuana on private property for personal use remains illegal.

Why? In November 2012, Washington voters passed Initiative 502, which legalized marijuana but did not legalize home grows.

Washington’s more cautious approach to home cannabis cultivation was rooted in other states’ experiences, said Brian Smith, the communications director with the Washington State Liquor and Cannabis Board.

“The states that have home grows, it hasn’t always gone the way they liked it,” Smith said.

As Daniel Shortt, an attorney with the Seattle office of the law firm Harris Bricken, pointed out, one cause of concern around home cultivation for a state like Washington is the tension between tracking those plants and an individual’s right to privacy.

“It’s easier, theoretically, to divert marijuana if it’s being grown by an individual. [In] these programs, as is implied in the name, the marijuana is cultivated in a person’s home," Shortt said. "And under the U.S. Constitution and every state constitution, there are protections afforded to a person’s home.

“So you have that tension: that protection that’s afforded to individuals and their place of residence versus this idea of having a tightly regulated system of tracking and tracing marijuana.”

Still, Evergreen State residents could see some major changes to that aspect of their law soon.

MacGregor Campbell / OPB

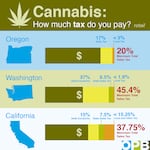

How Much Tax Will I Pay?

Proponents across the nation argue that one of the major selling points of legalized cannabis is the ability to tax a formerly black-market product that saw illicit sales in the billions. Of course, like everything else about legalization, the way each state taxes its cannabis varies in complexity.

In Oregon, a state with no general statewide sales tax, there is a 17 percent tax on recreational marijuana sales at the retail level. Each local municipality is able to implement an additional 3 percent tax, with voter approval. Maximum total sales tax: 20 percent.

Meanwhile, Washington customers can expect to pay a 37 percent excise tax — a sales tax per individual unit sold (similar to how gas taxes work) — plus the state's general sales tax rate of 6.5 percent. Purchasers also have to pay local county and city sales taxes on all recreational cannabis purchases. Maximum total sales tax: 45.4 percent.

California's tax system differs from its Northwest neighbors in that it taxes cannabis both in the form of a wholesale tax on cultivators and an excise tax on retail purchases. Once sales start on Jan 1, 2018, customers can expect to pay a 15 percent excise tax on all marijuana purchases at the retail level. That's in addition to the statewide general sales tax of 7.5 percent, plus local county and city sales taxes. And that's not counting the state's cultivation tax rates of $9.25 per dry-weight ounce of marijuana flower and $2.75 per dry-weight ounce of cannabis leaves charged to producers at the wholesale level. Maximum total sales tax: 32.75 percent.

MacGregor Campbell / OPB

Where Does All The Tax Money From Cannabis Sales Go?

All of those taxes obviously need to go somewhere once collected, and this is a major selling point for legalization: a boon to state coffers.

In Washington, the state collected $225,846,690 in tax revenue from cannabis sales for the fiscal year 2016. This included non-marijuana specific sales taxes collected on marijuana sales. That number is projected to jump for the fiscal year 2017 as the market continues to exceed expectations. In comparison, Washington hauled in a combined $476,512,822 in tax revenue from liquor, beer and wine sales for the same time period.

The bulk of the Washington cannabis tax revenue collected, 60 percent, goes toward public health programs, such as Medicaid, substance abuse prevention programs and community health centers.

California will also distribute the bulk of its revenue to various public health initiatives and programs. A huge chunk of the money California brings in, starting with $10 million in the first year and ramping up to $50 million per year by 2022, will be distributed in the form of grants to local health departments and community-based nonprofits offering mental health treatment, substance abuse treatment, job placement and other services.

Oregon is taking a different approach. Forty percent of revenue from its cannabis tax is going to the state's public education system. That resulted in a $34 million payout to the State School Fund in October 2017. But Oregon still gives 20 percent of the revenue to mental health, alcoholism and drug treatment programs.

What Does This All Mean For The Future Of Cannabis Legalization?

It’s important to remember that marijuana remains illegal at the federal level. As tensions between states’ rights and federal authority continue to play out, much of how these individual states regulate their markets could change. But federal law is less likely to see major shakeups in the coming months.

Shortt noted that Republicans are currently in power and have struggled to pass legislation that is important to their base, so it seems unlikely that Congress will tackle issues around cannabis legalization.

“Marijuana is, I think, becoming an increasingly important issue, but it’s still relatively minor compared to other issues that Congress faces,” Shortt said.

Like with all new industries, regulations don’t always work out as intended. For example, Washington has already made major changes to its marijuana tax system since it was legalized. The state used to charge 25 percent taxes on three levels — 25 percent at the production, 25 percent at processing and 25 percent at retail. The state simplified to its current 37 percent excise tax in 2015.

And while regulations are sure to change, some experts predict the market could be a $24 billion industry by 2025, so it's unlikely the wave of legalization will turn back.