Healthcare cost in Oregon increased almost 50% between 2013 and 2019 according to an OHA report.

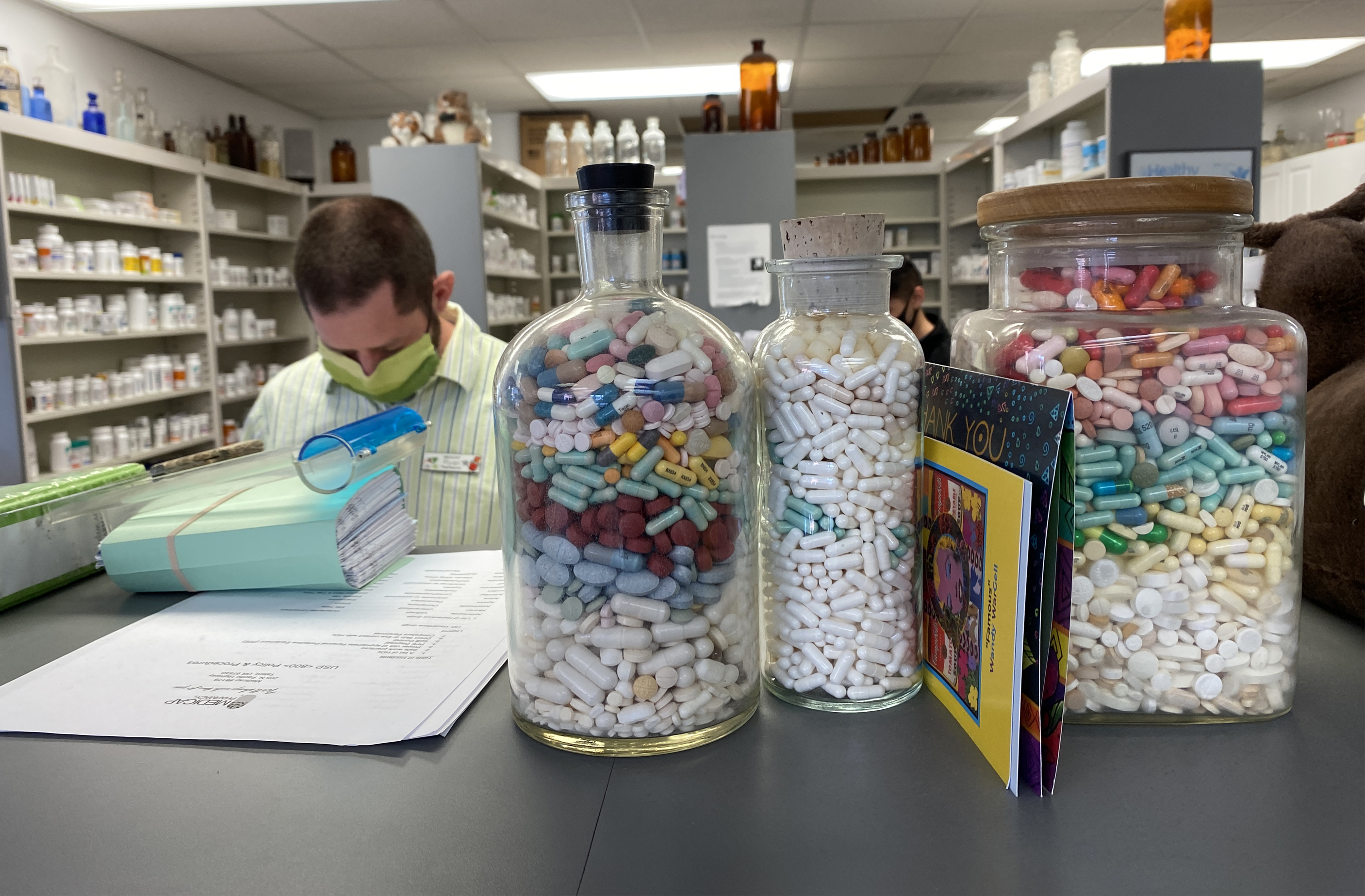

April Ehrlich / OPB

Healthcare costs for Oregonians went up 49% between 2013 and 2019. That’s according to a new report from the Oregon Health Authority. The report also shows that the biggest driver of that increase was the cost of prescription drugs. We’ll hear from Jeremy Vandehey, director of Health Policy and Analytics for Oregon Health Authority, on what else is driving this increase and how it is affecting Oregonians.

Note: The following transcript was created by a computer and edited by a volunteer.

Dave Miller: Healthcare costs for Oregonians went up about 50% between 2013 and 2019. That’s according to a new report from the Oregon Health Authority. The report found that Oregon’s increase was actually larger than the national average. Jeremy Vandehey joins us now to talk about the reasons for this increase, and the impact on Oregonians. He is the Director of Healthcare Policy and Analytics for the Oregon Health authority. Welcome back to Think Out Loud.

Jeremy Vandehey: Thanks Dave, Happy to be here.

Miller: Let’s start with the actual increases, plural, over this six year period, because they varied for the different categories of how people get their insurance, or get their insurance paid for: Medicare and Medicaid, meaning the Oregon Health Plan, and private insurance. How big were the increases for these different marketplaces?

Vandehey: That’s right. We have a pretty complex healthcare system, as most folks know, and people get their insurance and access to the healthcare system in a variety of different ways. The three big buckets we think about are Medicaid, which is generally folks who are lower income or disabled, Medicare, which tends to be folks who are older or disabled, and most of the state gets their health insurance through their employers, still about half. We saw, on average, the rate of growth across the entire state, about 7%. Medicare was by far the largest of that. Second was commercial, and then finally was with Medicaid. So Medicaid rates were actually growing slower than those other two.

Miller: 7%? I thought it was nearly 50% on average?

Vandehey: I’m sorry, 50% was the cumulative growth.

Miller: Over the six year period.

Vandehey: That’s right, that’s right. And on average, year over year, it was about 7%.

Miller: How do those increases compare to inflation over that period? This is before the really crazy inflation we’ve seen in the last year. But how do they compare to inflation and wage increases?

Vandehey: This report is before the pandemic, we’ve got some indications of what’s been going on through the pandemic, but this report takes us up to 2019. So, as you state at the outset, it’s healthcare spending in Oregon, and this report is looking at the amount actually paid into the healthcare system, so it’s looking at the amount and insurers pay, but also the amount that that people pay themselves, out of pocket. In Oregon, that grew about what we talked about, just about 7%. Nationally, it was closer to 4%. When we look at a variety of other indicators. that amount is greater than pretty much every other economic indicator.

So nationally, inflation grew during that period just under 10%. Healthcare grew about 49% in Oregon. Medical inflation, which is sort of healthcare inflation at the national level, grew about 17% versus 49%.

I think what’s probably more meaningful for Oregonians is comparing what’s happening with healthcare spending and healthcare costs compared to their own incomes and wage growth. Over that period, healthcare spending in Oregon grew 49%. Per person income grew 31%, and wages grew about 21%. So we’re talking about healthcare spending growing almost twice the rate, or actually more than twice the rate, of what people are seeing in terms of increases in their take home pay.

Miller: Why? Why is it that healthcare spending is outpacing those other aspects of our economy?

Vandehey: This is the several billion dollar question that everybody’s trying to tackle, and unfortunately there’s no one single answer to it. It’s been on this trend, nationally and in Oregon, for decades. What we’re really trying to do here is shine a light on what those indicators are. This is part of a new program we’re launching, to be putting out more analysis that’s going to start to shine a light. What we saw here was that pretty much all parts of the healthcare system outpaced that wage growth. All of them. Whether it’s hospital care, whether it’s independent providers, pharmacy, they’re all growing faster than the rest of the economy and wages.

The biggest growth area was pharmacy. What we’ve really seen there is a lot of new blockbuster drugs. We’re seeing drugs come out that are for very small populations, folks with rare types of cancer, rare diseases, fantastic new treatments that are improving people’s lives, but at really enormous costs of $30,000 to $40,000 per patient. There’s one cancer drug, as an example, that’s $373,000 a dose.

Miller: $300,000 plus, for one dose?

Vandehey: For one dose. Of course, some people see that entire cost, if they don’t have insurance, or they have really high deductibles. A lot of folks don’t see the amount the insurance company is paying, so you may only see that you’re paying a $5,000 deductible, which is not nothing by any means, that’s a huge hit, but a lot of times people don’t see these cost increases that are really being paid by insurers and then, ultimately, trickle down to consumers.

Miller: Although, this is where the way paying for health services in this country gets so mind bogglingly and infuriatingly complicated. Is it possible that no one’s actually paying that full $300,000 or more for one dose? That it’s on paper, but because of various complicated deals, it’s always a kind of imaginary price?

Vandehey: Well, the cost growth is not imaginary, right? The fact that healthcare spending has increased 49%. That’s real. Your point is really well taken, that we have an extraordinarily opaque system, and it’s most opaque with pharmacy costs, because actually what happens is the insurer pays an amount, and then later they get a rebate. The consumer sees none of that. It’s very hard to sort all that out, and it’s very hard to figure out exactly what the price is.

Stepping away from pharmacy for a second; prices within the health care system are all over the place. It’s not in this report, but another one we put out; a normal delivery of a baby in Oregon can range from $5,000 to $20,000, depending on which hospital door you walk through, and consumers usually have no idea, and often don’t know until after they get the bill for their deductible or copay.

Miller: We’re talking about a number of different systems at once here, as you noted at the beginning, which includes some free services, but also insurance premiums and copays and deductibles and various prices and systems for paying for pharmaceuticals. What’s the connection between this nearly 50% over six years price increase, and the actual out of pocket expenses for Oregonians? The actual money that Oregonians are spending?

Vandehey: What we’re seeing is that as health care spending and overall health care costs go up, that ultimately that trickles down to premiums. Insurance providers set their premiums based on what they think they’re going to have to pay providers in the healthcare system. As those premiums go up, in the employer market, where about half of Oregonians get their coverage, we’re seeing deductibles increase to try to keep premiums down. We’re seeing copays increase to try to keep premiums down, and we’re seeing a larger and larger share of the premium being shifted to employees.

It’s really a double whammy for families in the state. What they’re seeing is, as healthcare spending goes up, employers have to spend more money on that, which is less money they can put into wages. At the same time, they’re shifting the cost to employees through deductibles, co-pays, and premiums. We’re seeing those increase dramatically faster than wages in the state.

Miller: Do you have a sense, then, for what healthcare overall costs the average Oregonian, right now, as a percentage of income? And how that’s changed?

Vandehey: If you look at the amount that people pay, basically out of pocket, out of their take home pay, what they have deducted from their paycheck, or they’re paying copays, it’s about 10% of their take home pay. 10.1% If you look at the amount that an employer and the employee combined pay, it’s about 30% of income. So if you think about the total benefit package that an employee has, they have income and they also now have these healthcare benefits, it’s about a third.

To give you a sense of scale here, the average family premium, when the insurer is covering the whole family, parent, one individual or spouse, and kids, that right now is just under $20,000 a year. Basically a new car for each family, every year.

Miller: It’s actually a helpful way to think about that, because even though the employer is paying for it, we can imagine in a different world, potentially either employers could just suck up that money and have more profits, or they could put that towards compensation in the form of salary. So it really is money that potentially could be going into employees pockets.

Vandehey: Yeah, and I think that’s really important because we’re in a high inflationary period. Housing prices are skyrocketing. I’m sure it’s no surprise, second to the most expensive thing that the families have, healthcare, is housing. We’re in a wage growth period, we’re in a rapidly evolving economy with employee shortages all over the place. Now is the time when employers need that flexibility for wage growth, but what we’re seeing is healthcare costs are also skyrocketing and eating that up. That’s going to be a real challenge to sort through over the next several years.

Miller: I want to turn back. The average cost of healthcare for Oregonians went up nearly 50% total between the years 2013 and 2019, but Jeremy, as we talked about at the very beginning, there’s actually a lot of variation when you look at price increases for different populations, for Oregon Health Plan, for Medicaid, for private insurance, which was in the middle of the price increase, although closer to the top was Medicare. Why was the increase for Medicare so much bigger, for example, than for Medicaid?

Vandehey: With Medicare, it was pharmacy as well. We saw very rapid growth in pharmacy spending within Medicare, and that was largely due to what I said at the beginning, specialty drugs. There’s a lot of specialty drugs that are really focused towards folks with fairly rare and chronic conditions, and we see a probably higher rate of that within the Medicare population, an older population and folks with disabilities. Spending on those drugs tripled over that period, from something like 6% to 20%, more than tripled. So far these increases in pharmacy costs really hit the Medicare program in particular. Again, I want to emphasize: these are amazing treatments. Unfortunately, though they’re coming at blockbuster prices that are really unaffordable.

Within Medicaid, at the same time, we launched a whole new delivery system within the Medicaid program, really aimed at trying to be more efficient, trying to contain costs and improve outcomes. Healthcare is one of these funny things where less is more, in some instances; if you’re healthy, you don’t need as much healthcare, and when you’re unhealthy, you need more healthcare. We built a whole new Medicaid system aimed at prevention and primary care, and trying to coordinate focused care to be more efficient, so that folks would be healthier and would need fewer hospital visits and things of that nature. We’ve had a whole series of reforms within the Medicaid program that I think this is showing are panning out, and actually are providing a better, lower cost option.

Miller: I’m glad you brought that up because that’s the flip side of Medicare. You see the fact that the Medicaid population saw the lowest increase in healthcare costs, significantly lower than the private market, as, in a sense, validation of the big changes. A big experiment that Oregon has been undertaking for a decade now, essentially, is coordinated care organizations. This, in your mind, is evidence that something actually is working?

Vandehey: Absolutely. And I think it’s important to not just look at the money figures in that as well. What we’ve seen in other analyses within the Medicaid system is we’ve seen health outcomes and quality improve. We’ve seen people’s reported health status, how healthy they say they are, improve. We’ve seen access improve, or at least be sustained over that period of time. We’ve seen a lot of other indicators that it’s not just saving money, but actually improving health and improving quality as well.

Miller: Let’s turn to the other interesting fact here: that Oregon saw a bigger increase, and pretty significantly bigger increase, in overall health costs between 2013 and 2019, than the national average. Why is that? These blockbuster drugs were available everywhere. Every place has these three different kinds of insurance. Why is Oregon having a faster increase?

Vandehey: I think that’s the big question here. We are, as I mentioned at the beginning, in the process of, and have launched a new, we’re calling it a Statewide Cost Growth Target Program. In essence, what we’ve said is that number is unsustainable. We’ve set a new target of 3.4% growth, which, as you can see in this report, we’re about twice that right now.

Miller: That’s annual growth?

Vandehey: Annual. That’s right. That’s sort of like a budget target. It’s a program the Legislature passed a couple of years ago and is now off the ground. The idea is just like a household budget; if you’re spending way too much and your credit cards are going up and you’re out of money every month, the first thing you need to do is say, well, how much money can I spend? Then you start measuring where you’re spending it, and that’s what we’re doing here.

Miller: But what does it mean? Sorry to interrupt. What does it mean for the Legislature, or anybody at the state level, to say ‘we’re going to not spend more than x percent more a year on healthcare’, when we’re talking about, to a great extent, a national system? Whether we’re looking at how much things cost, set by Medicaid and Medicare, or private insurers that may operate in a bunch of different states, how much power do we actually have at the state level to decide how much Oregonians will have to pay for healthcare?

Vandehey: I think it’s important that this program is not a cap. It’s sort of a goal. We’re setting a target and we’re measuring against it. We’re trying to figure out, if we’re not meeting it, why and where and what parts of the system aren’t? But it’s true that a lot of the money comes from the federal government and the healthcare system. Pharmacy, I would argue, really is a national issue. There’s some things we’re trying to do as a state, but that really is a very difficult thing for an individual state to tackle.

The rest of the healthcare system is local. It’s local providers, it’s local hospitals. The vast majority, 80% roughly, of what’s spent in healthcare really is going to the local community. It varies by community, is what we’re seeing. What we’ve seen is a big shift over time of services; there’s more and more services that can be provided outside of a hospital that used to require multiple days of staying in after a surgery. Now they can be performed at a lower cost, shorter stay setting, but hospitals still have a base cost. We’re not seeing hospital costs go down as a result, we’re just seeing more spending outside of the hospital, so we’re seeing a bunch of shifts within the local system.

One issue that I think we’ve been particularly worried about, the Legislature addressed this last session, is we’ve seen a lot of consolidation within the health care system. We’re seeing providers combined. We’re seeing hospitals buy up local providers. We’re seeing out of state companies buy local providers. Generally, the trend nationally is, when that happens, that increases purchasing power for that provider, and prices generally go up.

Miller: Jeremy Vandehey, thanks for joining us.

Contact “Think Out Loud®”

If you’d like to comment on any of the topics in this show, or suggest a topic of your own, please get in touch with us on Facebook or Twitter, send an email to thinkoutloud@opb.org, or you can leave a voicemail for us at 503-293-1983. The call-in phone number during the noon hour is 888-665-5865.