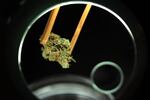

A worker examines a bud of the hybrid Gorilla Glue #4 strain at Little Amsterdam in Southwest Portland. Oregon recently began taxing recreational marijuana sales.

John Rosman / OPB

Oregon's recreational marijuana industry hit a milestone this month.

About 90 days into the legal sale of recreational marijuana, Jan. 4 marked the first time people could officially apply for licenses to operate recreational businesses in Oregon. And more changes are on the way.

By the end of the year, Oregon's cannabis industry will look a lot different from what we currently have.

When will new recreational retail marijuana stores be open?

Although the state is accepting business license applications, the Oregon Liquor Control Commission — which will oversee the state's recreational marijuana business solely starting in January 2017 — doesn't plan to approve any of the retail store applications until at least the fourth quarter of 2016.

Related: 10 Things To Know About Recreational Marijuana Sales

“Around October is what we’re projecting," said OLCC spokesperson Mark Pettinger. Pettinger said the OLCC's priority right now is licensing outdoor marijuana growers.

"The idea right now is to focus on the outdoor grow applicants because they’ll need to get the crops in the ground soon. As opposed to indoor grow operations, which are going to have multiple cycles to grow throughout the year," he said.

No doubt the regulators in Oregon learned from the roll-out of recreational cannabis in Washington, which was hamstrung by short supply in the early months.

After getting the growers licensed, Oregon plans to license laboratories, processors, wholesalers, and — lastly — retailers.

Until retail marijuana stores do open, licensed medical marijuana stores in Oregon can continue to sell recreational marijuana products — but only until Dec. 31. On Jan. 1, 2017, medical stores will no longer be able to conduct recreational sales.

Can recreational stores now sell edibles, oils, etc.?

Technically, yes.

Recreational stores will be able to sell the same types of products currently sold at medical marijuana dispensaries when the former begin opening later this year.

The Oregon Liquor Control Commission is still working on its regulations for cannabis edibles and concentrates, so until the regulations are approved those products are available only to medical marijuana customers.

Bryan M. Vance / OPB

One key difference in the medical and recreational system, however, is that recreational stores won't have products at the same dosage levels. Medical marijuana dispensaries can provide higher potency products to patients because of their medicinal needs.

And even though the recreational stores can technically sell products like edibles, creating labeling standards could delay those products from Oregon's retail shelves until sometime in 2017.

The OLCC is still working on those standards, in conjunction with the Oregon Health Authority, which will determine dosage levels for different marijuana products.

Will medical marijuana dispensaries still be allowed to conduct recreational use sales?

Yes, for now. The Oregon Health Authority is overseeing the state's early adoption of recreational marijuana sales, allowing medical dispensaries to conduct sales through Dec. 31. At that point, however, medical dispensaries will no longer be able to conduct recreational sales.

Can a medical marijuana license holder also hold a license for recreational marijuana growing, production or sales?

With the OLCC taking complete control of recreational cannabis regulation Jan. 1 this year, it's likely going to force many consumers to visit new shops.

That said, you may still be able to shop for your recreational marijuana from the same company that ran the dispensary you were buying from, so long as the recreational and medical stores operate completely separate from one another.

"You can’t have a one-size-fits-all in the sense that you’ve got one place that’s serving medical and is serving recreationally," Pettinger said. "It has to be one or the other."

Basically, business need two different store fronts for two different products. Things are slightly different for growers.

There are two ways a medical marijuana grower can produce for the recreational market. One way would be to simply surrender the medical growing license and apply for a recreational license. Alternatively, if a medical growing operation can get permission from the cardholders it serves, it could sell excess product to the recreational marijuana industry.

"The requirement, though, is that they be a part of that cannabis tracking system. So right now, the medical marijuana market does not have that requirement and that’s not a requirement from the OHA,” Pettinger said.

What else changed about Oregon's recreational marijuana sales on Jan. 4?

The tax holiday is over. That's the only thing that actually changed for consumers on Jan. 4. The rest of the changes won't start to impact consumers until later this year. Since recreational marijuana sales became legal in Oregon on Oct. 1, 2015, they've been tax free.

I have to pay a sales tax? How much?

Yep, even though Oregon doesn't have a general sales tax, it does impose a 25 percent sales tax on recreational marijuana sales at medical dispensaries as of Jan. 4.

"Dispensaries can set whatever price they choose for their products, but the price must be set up front and the law requires consumers be issued a receipt showing the price and tax they're paying," said John Galvin, manager of the Marijuana Tax Program.

The first weeks of that tax haven't been entirely smooth.

As the Oregon Department of Revenue has noted, medical dispensaries must register a tax with the department before remitting payments or filing returns. As of early January, less than half of the 284 medical dispensaries selling recreational products have registered.

A wide variety of extracts, concentrates and edibles are sold at medical dispensaries such as Little Amsterdam in Southwest Portland.

John Rosman / OPB

The 25 percent tax isn't permanent, however. When OLCC-licensed recreational marijuana stores begin to open later this year, they'll drop the charge to a 17 percent state sales tax, with local municipalities able to tack on up to an additional 3 percent — bringing the maximum to 20 percent.

Comparatively, retail consumers pay a 37 percent sales tax on recreational marijuana purchases in Washington state. In Colorado, recreational marijuana purchases are subjected to a 10 percent state marijuana tax on top of the 2.9 percent state sales tax. Local municipalities can also add on sales taxes in Colorado.

What's Oregon doing with all that tax money?

Initially, the tax revenue collected from retail sales will go to cover the Oregon Department of Revenue's costs to collect the new tax. Then some of it will go to pay for OLCC's costs associated with launching the recreational marijuana program.

But once those payoffs are complete, the Oregon Department of Revenue says the sales tax revenue will be dispersed in the following way:

- 40 percent will go to Oregon's Common School Fund

- 20 percent will go to Oregon's Mental Health Alcoholism and Drug Services Account

- 15 percent will go to Oregon State Police

- 10 percent will go to participating cities' law enforcement offices

- 10 percent will go to participating counties' law enforcement offices

- 5 percent will go to the Oregon Health Authority for alcohol and drug abuse prevention, early intervention and treatment services

How will the OLCC make sure the marijuana doesn't wind up in the hands of criminals?

Related: Marijuana Breathalyzer Under Development To Nab Drivers Taking the 'High' Road

A concern for some recreational marijuana opponents has been how the state will keep criminals from profiting from legalization.

To help prevent marijuana or marijuana profits from falling into the wrong hands, the OLCC will require all recreational marijuana plants and products to be tracked from seed-to-sale using a cannabis tracking system.

Basically, when plants are immature clones, they're associated with an RFID tag that will stick with that plant through the entire process.

"Let’s say the product from one plant is then turned into an extract, which is then turned into an edible, which then becomes a cannabis chocolate bar, which then gets packaged into a lot of 10 bars in a case, which gets shipped to two or three different stores," Pettinger said. "That product is tracked at every step along the way."

Another benefit of the tracking system is it allows the industry to easily know where products came from if a recall occurs.

What if my city/county is dry?

Although the state did legalize the use and sale of recreational marijuana, it gave local communities the opportunity to ban sales and production. So far, 89 cities and counties have opted to prohibit either the production, processing, wholesaling or retail sales of recreational marijuana. Some communities will have a chance to challenge those decisions on the ballot. That said, if your city or county does opt to prohibit recreational marijuana, it won't get a share of tax revenue.

For some perspective on the potential returns, Washington state brought in more than $67 million in tax revenue from recreational marijuana in its first year of operation. Comparatively, Colorado brought in almost $70 million in revenue from marijuana taxes during the first fiscal year of legalization, according to TIME.

For more information about Oregon's recreational marijuana industry, check out the state's recreational marijuana FAQs.